Dubai, UAE – 9 October 2024: Bayut, the UAE’s leading property portal, has unveiled data on the most-searched areas in Dubai’s real estate market for the third quarter of 2024. Property prices in Dubai’s most popular areas have continued to surge, with strong sales figures, robust demand and availability of new inventory continuing to fuel growth well into the next year.

Trends in Property Buying in Dubai

- Bayut’s data shows notable price increases in prominent Dubai neighbourhoods for both apartments and villas, with villa prices in Arabian Ranches experiencing a significant rise of up to 13% in Q3 2024.

- Affordable property buyers and investors have shown heightened interest in areas such as International City, Dubai South, DAMAC Hills 2 and Dubailand. Mid-range buyers have continued to search for units in neighbourhoods like Jumeirah Village Circle, Jumeirah Lake Towers, Al Furjan and Reem. Meanwhile, luxury property investors have focused on areas like Dubai Marina, Business Bay, DAMAC Hills and Dubai Hills Estate.

- Transactional prices for affordable apartments in highly-searched areas have generally declined by up to 11%, while villa prices in Dubailand saw a sharp rise of almost 20% in transactional price, driven by increased demand for affordable homes.

- In the mid-tier segment, apartment and villa transactional prices have risen by up to 8%.

- Luxury property prices have also seen consistent increases in transactional prices, rising between 3% and 31%, with the highest price hikes recorded in Dubai Hills Estate.

- According to Bayut’s Dubai Transactions data, based on meticulously processed information from the Dubai Land Department (DLD), Q3 2024 witnessed over 48,000 property sale transactions overall amounting to over AED 120 billion. When it comes to the specific segments, over 16,000 of these transactions came from the ready segment, with value exceeding AED 51 billion, while for the off-plan segment there was a significantly higher number of over 32,000 transactions with a value exceeding AED 70 billion.

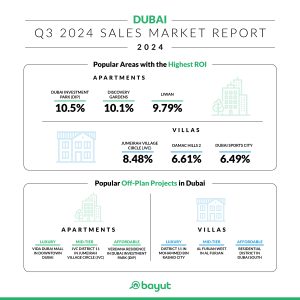

Return on Investment (ROI) Trends for Dubai Properties

- In terms of ROI, areas such as Dubai Investments Park (DIP), Discovery Gardens and Liwan have reported the highest yields for affordable apartments, offering returns of 9% to 11%. In the mid-tier segment, Dubai Sports City, Dubai Silicon Oasis and Town Square provide attractive yields exceeding 8.6%. For luxury apartments, locations like Al Sufouh, DAMAC Hills and World Trade Centre have yielded returns of 7% to 9%, surpassing many global markets.

- For affordable villas, DAMAC Hills 2, International City and Serena offer returns above 6%. Mid-tier villa communities like Jumeirah Village Circle, Dubai Sports City and Jumeirah Village Triangle provide ROIs ranging from 6% to 9%. In the luxury segment, Al Barari and Tilal Al Ghaf offer returns exceeding 6%, whereas Jumeirah Golf Estates and Al Barari offer returns of up to 6%.

Trends in Renting Properties in Dubai

- Bayut’s data reveals significant increases in rental prices across various segments. Affordable apartment rentals have risen by up to 28%, with the largest price hike recorded for the 1-bedroom flats in Deira. Mid-tier apartment rentals have increased by up to 12%, while luxury apartments also saw moderate growth, with a maximum increase of 9%. The 1 and 2-bed units in Business Bay and Dubai Marina reported slight declines of under 4%.

- Villa rentals in the budget segment have generally increased by up to 10%, however there have been price declines of up to 11% recorded for 5-bed houses across all popular districts. Mid-tier villa rentals rose by as much as 42%. The highest uptick was recorded for 4-bed units in Al Furjan, following the handover of properties in Murooj Al Furjan. Luxury villa rentals surged by up to 15%, with Jumeirah registering the highest increase for its limited inventory of five-bedroom units.

- For affordable rentals, Deira and International City have become popular choices for apartments, while DAMAC Hills 2 and Mirdif have attracted interest for villas. Mid-tier apartments in Jumeirah Village Circle (JVC) and Bur Dubai remain in high demand, while JVC and Al Furjan have been popular choices for mid-tier villas. In the luxury rental market, Dubai Marina and Business Bay continue to be sought-after for apartments, while Dubai Hills Estate and Al Barsha have been the top choices for high-end villas.

- Transactional rental prices for both villas and apartments have generally increased by 1% to 14% in affordable areas. In the mid-tier and luxury segments, rental prices have seen increases of up to 10%.

The Dubai property market is currently experiencing a period of strong demand, driven by various factors such as economic growth, an influx of foreign investors and a booming tourism sector. With developers closely aligning supply with market demands, the sector is expected to continue this momentum, with no significant risk of oversupply for the next four to five years. The city also continues to witness a surge in property prices, supported by the robust demand for both luxury and mid-tier developments.

Commenting on the findings, Haider Ali Khan, CEO of Bayut and Head of Dubizzle Group MENA said:

“Dubai’s property market is booming, and we’re set to see further growth, with sales volumes expected to rise through 2024 and 2025. The market’s momentum is driven not only by a stable demand-supply balance and steady investment, but also by the surge in proptech innovations that are transforming real estate transactions, making them more transparent and efficient.

As a leader in real estate technology, Bayut has continuously worked to integrate AI and advanced tools into the property market. From BayutGPT, the world’s first AI-powered property search assistant, to TruEstimate™, offering accurate property valuations, we’ve made it easier for buyers and sellers alike. Our newest innovation, TruBroker™, simplifies the process further by connecting users with trusted, high-quality agents. As Dubai’s property market continues to grow, we’re committed to keeping pace with innovative solutions that enhance the experience for everyone involved.”